Recently State Street Investment Management released premium income fund on their series of successful sector funds. For example for XLK, which is technology focused, they have released XLKI – The technology Select Sector SPDR Premium Income Fund

Now the underlying holder for XLKI is, as can be predicted :), XLK, some money in the money market, and most importantly the calls on XLK. Obviously I don’t believe these will be covered calls, I think they will be calls sold. It is written this way in their prospectus:

Now if you look at today’s composition of XLKI, it is as follows:

This means if the XLK goes above 275 + whatever premium that is collected, by Sep 19th, the ETF will lose money, otherwise it will have a profitable month of operation, and that is the premium that will be distributed.

Now XLKI has already paid a dividend of $0.48 (48 cents) on ~$25.50 (9/11/25), so even if you consider a continuing dividend of $0.25 on $25.50, that will yield ~11% returns. So in my books this is a good buy.

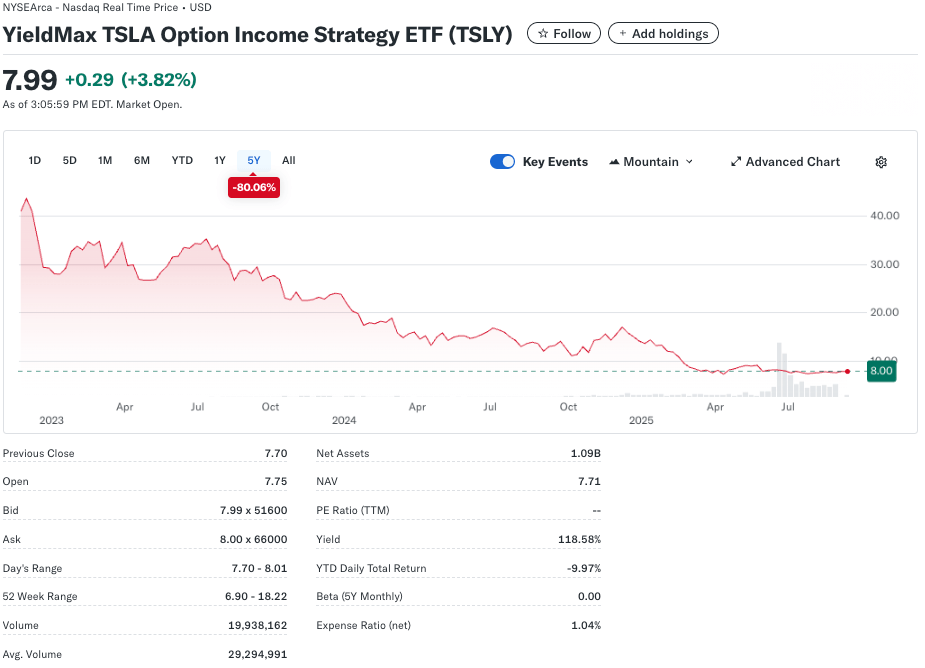

What are the risks – many times, covered call ETFs if not managed properly start eroding your capital, take example of TSLY:

Even though the calculated yield on today’s price is massive 118%, the overall loss in capital over last 5 years is 80% – that means the $100 invested became $20.

Of course State Street is not YieldMax, and every company is different. I see that State Street has started very cautiously with ~$1M in AUM, knowing their history, I believe it will evolve in JEPI or JEPQ way.

So I am buying this ETF in very small quantities – 1 or 2 here and there, and 5 or so when the prices fall. Want to observe the overall performance and success rate, before putting additional money in it.

Leave a comment